Crude Oil Sentiment – QuantCube’s indicator predicts OPEC+ deep oil production cuts

OPEC+ agreed to decrease oil production on October 5. According to OPEC+ this is to combat the decreasing oil prices as the world economy slows. As a result, 2 million barrels per day of output or nearly 2% of global supply will be cut. The announcement came when the world market continues to suffer from tight energy supply mainly due to disruptions introduced by the war in Ukraine.

During a challenging period, sentiment analytics supported by Artificial Intelligence can help market participants gain actionable insights in real-time. At QuantCube we developed proprietary NLP (Natural Language Processing) algorithms to track the trend in Crude oil production and price sentiment based on social media textual data in Arabic and English. Our sentiment indicators are computed over a 1-hour window and refreshed every 5 minutes. They aim at detecting multiple factors that impact Crude oil production and prices in real-time.

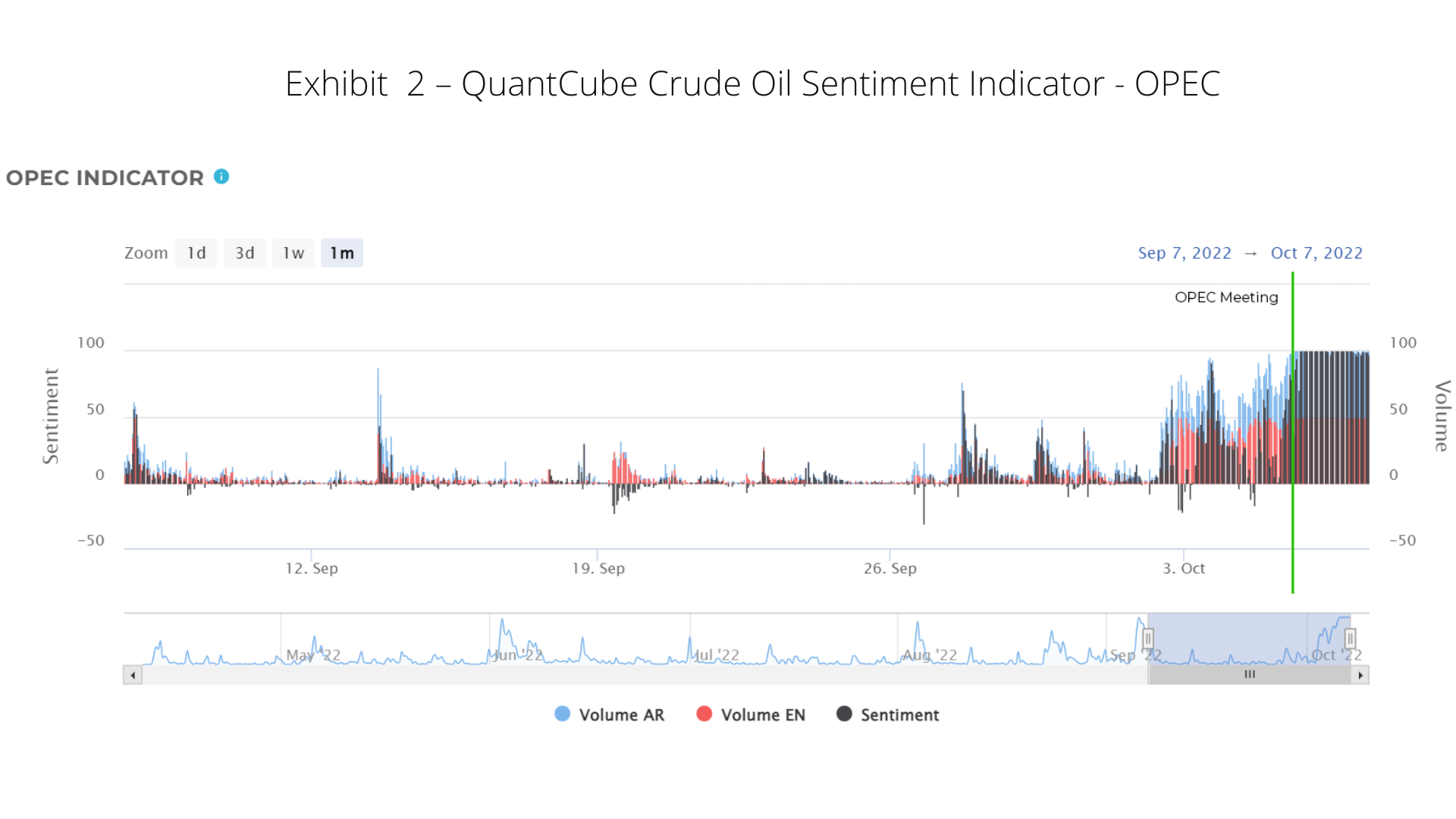

The graphs below show the trends in the two QuantCube Crude Oil Sentiment Indicators from September 7 to October 7 2022. The indicators are designed to detect sentiment towards OPEC and oil production globally based on social media posts in Arabic and English. The columns in red and blue represent the number of social media posts in the respective languages, while the black columns indicate the sentiment derived from the texts analysed.

Exhibit 1 indicates that social media posts discussing Crude oil production increased significantly in recent weeks. Well before the OPEC’s announcement on October 5. Our in-depth text analysis using NLP detected negative sentiment for Crude oil production. This corresponds to a recent increase in oil price in the energy markets.

The observation was supported by the sentiment analysis towards OPEC (Exhibit 2). A number of social media posts about OPEC started to increase significantly too from Oct 2, most likely anticipating the decision by OPEC+ to reduce oil production.

The OPEC’s decision to reduce oil production fuelled further inflationary pressure, and increased geopolitical tension and uncertainty about energy supplies. An early detection of changes in oil production trends is one of the key factors to assess the current energy market condition. We will continue to monitor this with our Crude Oil Sentiment Indicators.