Enhancing risk management – hedging volatility with alternative data

Macro Insight

Hedging volatility with QuantCube’s dynamic quadrant analysis to mitigate risk

Predicting stock market volatility is challenging due to its unpredictable nature. However, achieving proficiency in this area can significantly enhance investors' risk-adjusted returns. Central to this effort is timely and precise analysis of macroeconomic conditions, which is crucial for identifying potential spikes in volatility. A robust economy generally instills optimism and stability among investors, whereas economic downturns may indicate increasing uncertainty and the potential for heightened volatility. However, the infrequent release of official macroeconomic data poses a significant challenge, often making these indicators obsolete by the time they are published. To address this issue, QuantCube employs its dynamic quadrant to swiftly identify sudden increases in endogenous volatility by continuously analysing macroeconomic data in real-time.

Based on Nowcasting trends for GDP growth and inflation outlook, the QuantCube Dynamic Quadrant identifies four macroeconomic regimes in real-time: Heating Up, Goldilocks, Stagflation and Slow Growth, as illustrated in Exhibit 1.

For example, when Leading GDP growth in China and the US are both showing negative, trends, alongside a downward trend in US inflation, this signals a Slow Growth regime or Risk-off mode, indicating a global slowdown in economic growth. The other three regimes are classified as Risk-on mode.

Effective detection of volatility spikes using real-time macroeconomic data

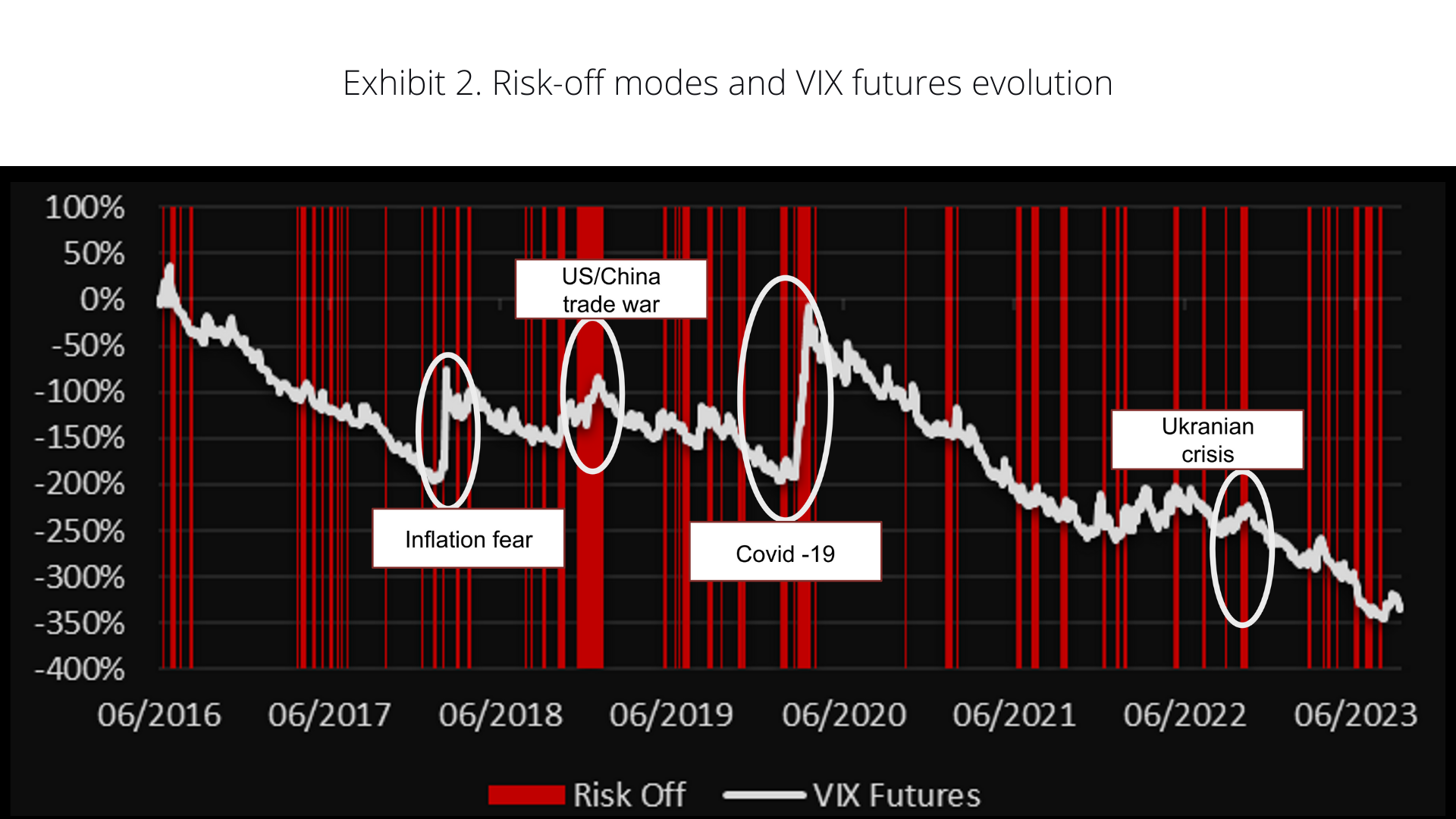

Exhibit 2 illustrates the trajectory of VIX futures returns since 2016, highlighting periods of slow growth or risk aversion identified by the QuantCube Dynamic Quadrant during the same timeframe. VIX futures experienced significant spikes during major market downturns, particularly amid the China-US trade conflict in 2018, the Covid-19 outbreak in 2020, and the energy crisis resulting from Russia's invasion of Ukraine in 2022. Our macro indicators have effectively and promptly identified significant market drawdowns.

Generating positive returns with long VIX futures strategy in Risk-off environments

Investors and traders can leverage QuantCube’s dynamic quadrant to trade VIX futures effectively and mitigate the impact of volatility spikes within their risk management strategies. This could include:

Portfolio Hedging: Investors can hedge against market downturns by using VIX futures, which typically appreciate in value as volatility rises. Buying VIX futures can aid in offsetting equity portfolio losses during turbulent market conditions, as these instruments appreciate in tandem with spikes in market volatility.

Diversification: The VIX index demonstrates clear counter-cyclical behaviour.

VIX futures, which move inversely to the stock market, can offer diversification benefits to portfolios. Indeed, they can offset equity losses by appreciating in value during periods of heightened market volatility and declining equity markets.

Using solely the high frequency Risk-off signals from the QuantCube Dynamic Quadrant analysis, we simulated a long-only strategy on VIX futures. Exhibit 3 illustrates the back-testing results for this strategy, which initiates a long position in VIX futures when the market is expected to underperform— specifically, during periods of slow growth. During other scenarios, i.e. Risk-on mode, no action is taken.

This long-only VIX futures strategy has delivered a significant total return of 142.9% from 2016 to 2024, with a Sharpe ratio of 0.56 throughout the entire period while being invested only 15.7% of the time. In addition, the trades achieved higher average positive days (+4.8%) than negative days (-2.3%).

Although macroeconomic data may occasionally fail to capture volatility spikes caused by external factors such as geopolitical events, our analysis suggests that the dynamic quadrant remains effective in identifying internal volatility. It plays a vital role in protecting investments from market downturns. To further enhance this tool, QuantCube has developed additional indicators on risk and sentiment. These indicators are specifically tailored to detect the external shocks that macroeconomic indicators often overlook, thereby providing a comprehensive and robust analytical framework.