Fed watchers - more rate hikes or a pause for now ?

Macro Insight

QuantCube’s new insights into the US macroeconomic outlook

How does alternative data for inflation help to decipher fixed-income trends in real time ?

Over the past eight months US inflation has been drifting downwards in reponse to the continuous rate hikes imposed by the Fed. The drop in headline inflation can mostly be explained by a price decline in the cyclical components. In particular, Food & Energy prices, which had skyrocketed after Russia invaded Ukraine last year, have recently been trending down to ease inflationary pressure. On the other hand, Core inflation, which excludes these volatile sub-components, has been stubbornly hovering above 5 percent. Although cyclical inflation is easing and the credit market recovering, there are persistent underlying inflationary pressures, therefore, the Fed has been reluctant to pause its monetary tightening so far. The next release of Core inflation may be the key to determine whether the Fed will hike rates further or pause.

Our US CPI Nowcast provides investors early insights into the current level of inflation in real-time and detects inflection points ahead of the publication of official data. By collecting and analysing the prices of goods and services at the most granular level, we track the main sub-components of the US CPI on a daily basis - Core Goods, Core Services and the cyclical components of Food & Energy. The indicator for Core CPI focuses on the persistent and fundamental factors driving inflation with the aim to provide a stable and clear pictures of price pressures in real-time. Exhibit 1 shows the evolution of the QuantCube Headline US CPI Nowcast and the QuantCube Core US CPI Nowcast over the last year. Our daily estimates during May 2023 have confirmed easing US headline inflation - it stands at +4.5% YoY as of May 30, a drop from the previous +5.2% recorded on April 30. As for underlying inflation, our Core Nowcasting Indicator shows a loss of steam during the last few weeks.

While core inflation is still outpacing headline inflation, we observe all CPI components are declining. Exhibit 2 shows the trajectories of each component in the QuantCube US CPI Nowcast. Due to the demand shock experienced globally, Food & Energy CPI soared in October 2021 during post-Covid reopenings. The start of the war in Ukraine in early 2022 and the subsequent disruption in oil and grains supplies fuelled existing inflationary pressures further. As a result, Food & Energy inflation increased steeply to peak in June 2022. Our indicator successfully captured the definitive peak or turning point early, i.e. in the last week of June 2022, two weeks ahead of the publication of official data.

The Core Goods component was also affected by the demand shocks and global supply chain disruptions experienced by the US economy in late 2021. The rise in used car prices also contributed to higher overall prices for Core Goods.

Historically, the services sector component of CPI lags the most. It is normally influenced by domestic factors such as labour market dynamics, consumer demand and housing costs, whose main driver includes owners’ equivalent rent. Currently, our real-time Core-Services CPI Indicator is suggesting that the price pressure for Core Services has started to ease as observed in Exhibit 3. The Fed has been monitoring the Core Services CPI closely as a definitive sign of easing inflationary pressure in the US. The recent drop in Core Services prices might give room to pause interest rate hikes in the near future.

Capturing the change in the US yield curve using the QuantCube Core CPI Nowcast

As inflation dynamics is a key factor influencing central bankers’ monetary stance, CPI data dictates bond yield risk premia and the expectations of future interest rate changes. Rising inflation may imply potential interest rate hikes by central banks and this will consequently lead to higher bond yields in the future. Early and accurate insights into core inflation trends are critical to help anticipate significant movements in the yield curve.

Exhibit 4 represents the evolution of QuantCube’s Core CPI Nowcast and the US Treasury yield spread between 10 year and 2 year maturities. Between early 2022 and April 2023, a substantial increase in core inflation pushed the Fed to raise Fed Fund rates, which led to an inverted yield curve (negative 10 year minus 2 year yield spread). This occurrence is often seen as a warning sign of a potential economic slowdown or recession, with shorter term forward rates embedded in the yield curve implying future rate cuts. Recently, we observed core inflation cool down with an "un-inverted" yield curve. A Granger causality analysis conducted internally for the period between 2017 and the present indicates a causal relationship between the two variables. Using the QuantCube Core CPI Nowcast, users can anticipate the change in the yield curve approximately 20 days in advance.

Talk is cheap but money speaks: a EUR/USD case study

The trend analysis for inflation in the US and Germany using the QuantCube Inflation Nowcast is useful to estimate EUR/USD currency pair movements in real-time. Economies in the Eurozone and the US share similar characteristics in terms of financial and economic stability. When inflation rises in response to stronger economic conditions in one region relative to the other, investors expect the central bank to rise interst rates, and this in turn contributes to currency value appreciation. If, for example, the inflation differential suggests that the Euro is appreciating (or depreciating) versus the US Dollar, investors may go long in the EUR/USD currency pair or vice versa.

Exhibit 5 shows the cumulative returns of the EUR/USD futures strategy we simulated using the observation from the QuantCube Inflation Nowcast. The simulation tracks EUR/USD currency pair futures movements based on the differences in inflation trends. In this illustration, we are using the Quantcube real-time German inflation indicator as a proxy for Eurozone inflation.

The yellow line represents the cumulative return of the EUR/USD futures when the German inflation trend outpaces the US. In this macro regime, the Euro is expected to appreciate against the USD, thus giving a buy signal for the EUR/USD currency pair. On the other hand, the white curve represents the cumulative returns when inflation trends higher in the US compared to Germany, suggesting that the Euro is likely to weaken against the Dollar. In this situation, a short position in the EUR/USD currency pair is beneficial for alpha generation.

When inflation in the Eurozone is accelerating vs. the US (or decelerating), it’s a good time to buy (or sell) the EUR/USD futures. In our view the performance of such an active strategy is significantly influenced by macro regime changes. The QuantCube CPI Nowcast provides valuable insights into inflation data in real-time and ahead of official data. It is extremely useful for developing EUR/USD trading or hedging strategies by effectively identifying macro regime changes.

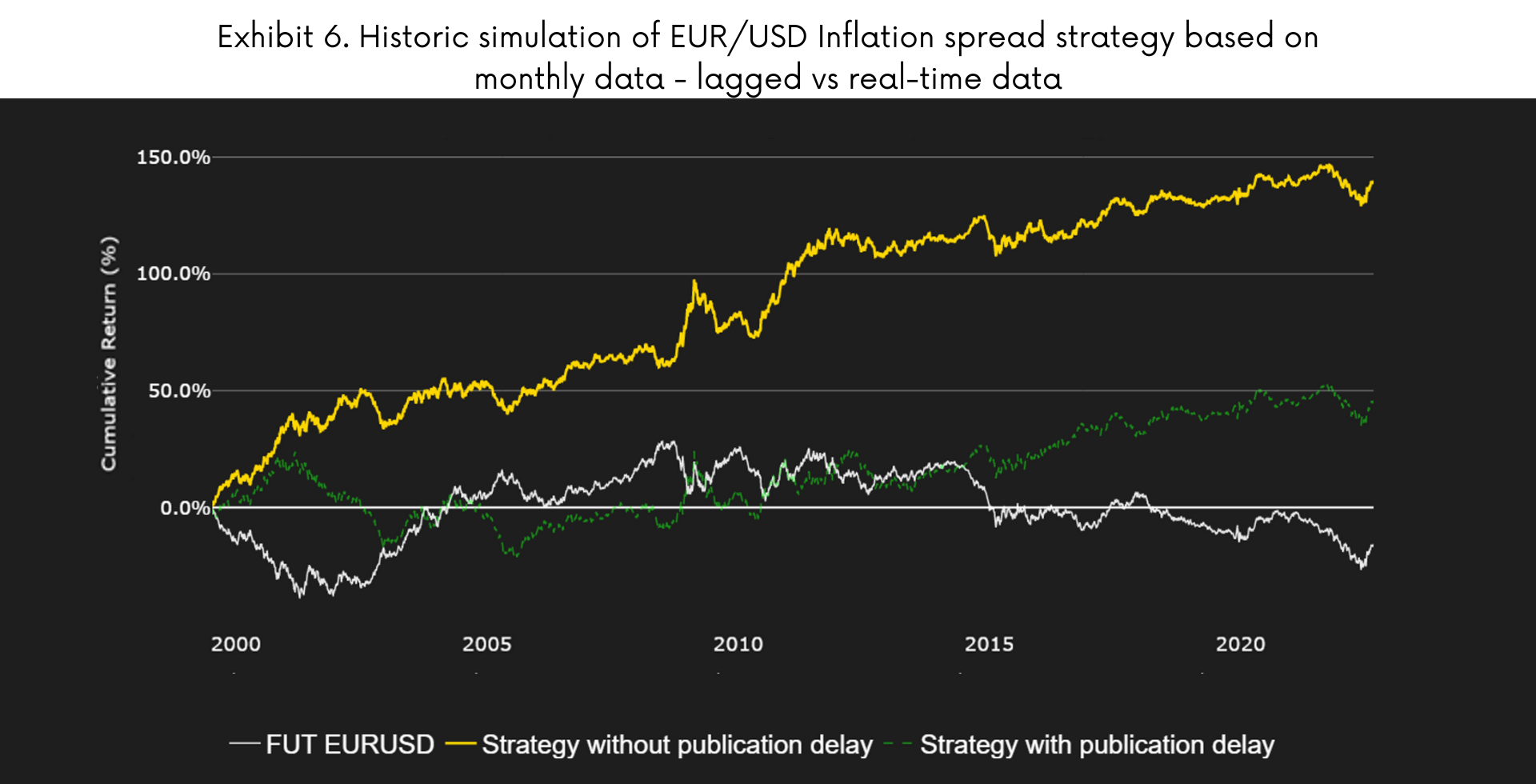

To give us more assurance that the above EUR/USD strategy is not based on a statistical fluke over a short observation period, we conducted a longer simulation based only on monthly official CPI data. Since alternative datasets are only available from 2016, we assumed that official inflation numbers were made available in real-time (i.e at the end of the month) as a proxy to the QuantCube CPI Nowcast. Exhibit 6 shows the cumulative returns of an active EUR/USD strategy vs. EUR/USD Futures benchmark from 2000 to the present.

The green line represents the cumulative returns of the strategy using official monthly data with a time-lag that corresponds with the publication release date (approximately 12 to 14 days after each month-end). The orange line represents the cumulative returns of the strategy assuming the US inflation data was available in real-time at the end of each month.

Our backtesting confirms that overall, adjusting the EUR/USD currency pair exposure based on the inflation trend differences between the US and Germany would generate superior returns against the EUR/USD futures benchmark. Most importantly, it shows that the strategy's performance is further enhanced when real-time data on inflation trends is available, i.e. on the last day of each month.

Table 1 provides further supporting evidence for the robustness of our fundamental approach. It indicates that an investment strategy using real-time inflation data achieved significant improvements in key metrics such as annual total return (net of transaction costs), volatility, and Sharpe ratio over the last 23 years.

In uncertain and rapidly changing economic environments, relying solely on monthly data may not provide investors with sufficient information to make timely and informed decisions. Instead of monthly data, investors will most likely benefit from the use of more frequent i.e. daily inflation estimates to evaluate rapidly changing inflation trends. Exhibit 7 shows the cumulative returns calculated for the EUR/USD inflation spread strategy over the last six years based on daily inflation updates using the QuantCube Inflation Nowcast for Germany and the US.

By incorporating the QuantCube Inflation Nowcasting Indicators, investors can dynamically adjust the exposures in the EUR/USD currency pair based on high frequency signals. As Table 2 indicates, reacting to the changing inflation outlook pro-actively in this way could improve the returns for the EUR/USD inflation spread strategy significantly. In particular, we observe that the Sharpe Ratio increased to 0.97 based on daily inflation updates, up from 0.61 using monthly real-time updates and 0.20 using monthly lagged data.

Of course, there are other factors influencing the performance of government bonds and currency movements other than inflation. To help capture subtle signs affecting macroeconomic outlook, Quantcube has developed various economic nowcasting indicators such as global economic growth and manufacturing growth. Our sector specific job openings nowcast and the commodity focused indicators are also useful to evaluate the dynamics of the global economy as a whole. Using these indicators, investors can identify potential macro regime changes ahead of the market and enhance their asset allocation process as we demonstrated above for fixed income and currency trading strategies.