Is a leveraged economy the weakest link for US growth?

Macro Insight

QuantCube’s insights into US manufacturing sector outlook

The US economy is starting to feel the effect of monetary tightening. While inflation is slowly cooling, the Fed’s aggressive monetary policy is challenging the health of the economy. Indeed, the combination of elevated prices, high interest rates and tightening credit conditions are weighing on consumer spending and industrial production, increasing the likelihood of a severe economic downturn. Predicting and assessing the size and depth of an economic slowdown by solely relying on official data can be challenging, particularly in a fast-evolving and uncertain economic climate. To provide an up-to-date assessment of economic conditions in the US, QuantCube analysed several alternative data sources to provide timely insights into industrial activity, international trade, consumption and employment. Our high frequency data are signalling a seriously deteriorating outlook for the US economy.

Worsening business investment activity

The Quantcube Manufacturing Nowcast (QMN) analyses textual data sources such as newspapers, financial news and specialised publications in real-time by leveraging our proprietary NLP algorithms to extract daily sentiment for the manufacturing sector. Our alternative data processing technology is designed to isolate and analyse key subjects for the industrial sector such as new orders, production, employment, export backlogs and inventories. The QMN indicator measures sentiment using the following method:

QMN reading above 0:

Indicates an expansion in the manufacturing sector. The higher the reading, the stronger the expansion.

QMN reading below 0:

Indicates a contraction in the manufacturing sector. The lower the reading, the stronger the contraction.

Exhibit 1 shows the trend in the QuantCube Manufacturing Nowcast for the US, China and Germany. The indicator for the US has been treading below zero for the sixth months preceding April 2023, suggesting that the contraction in the manufacturing sector is deepening. Furthermore, the industrial sector in the US seems to be doing far worse compared to Germany and China. The German QMN has recently recorded a recovery driven by rising orders and output; most likely stimulated by China’s post-COVID reopening. However, we see no evidence yet that the US economy is benefiting from China’s recovery.

Industrial production trending down

The bleak sentiment for US manufacturing activity is also reflected in the QuantCube Industrial Production Nowcast (IP Nowcast). We developed our IP Nowcast by processing real-time estimates of manufacturing, mining, and electric and gas utilities outputs. This indicator tracks year-on-year % change in official industrial production and provides daily updates of the economic activity and business cycle in the US. As demonstrated in Exhibit 2, the QuantCube Industrial Production Nowcast for the US has been recording a downward trend since November 2022.

Since the industrial and construction sectors tend to lead the business cycle in the US, the weakening industrial production level suggests that the likelihood of an economic downturn is increasing. However, much depends on the dynamics of employment and consumption. According to the official statistics and surveys, the services sector has been resilient so far. This means that the US economy could avoid a recession with a possible soft landing as long as consumer spending and the labour market remain solid. But is this likely to remain the case?

Note: QuantCube estimates for industrial production are not revised. The official data points reflect the latest update from the FED

The strength of the US consumer is fading

Consumer spending is considered to be the backbone of the US economy – accounting for nearly 70% of GDP. At QuantCube, we track private consumption in real-time at both country and sectoral levels to provide insights into current consumption trends ahead of the publication of official data. Exhibit 3 shows the QuantCube National Consumption Nowcast for the US. After reaching a peak in February, US consumption has been trending downward recently.

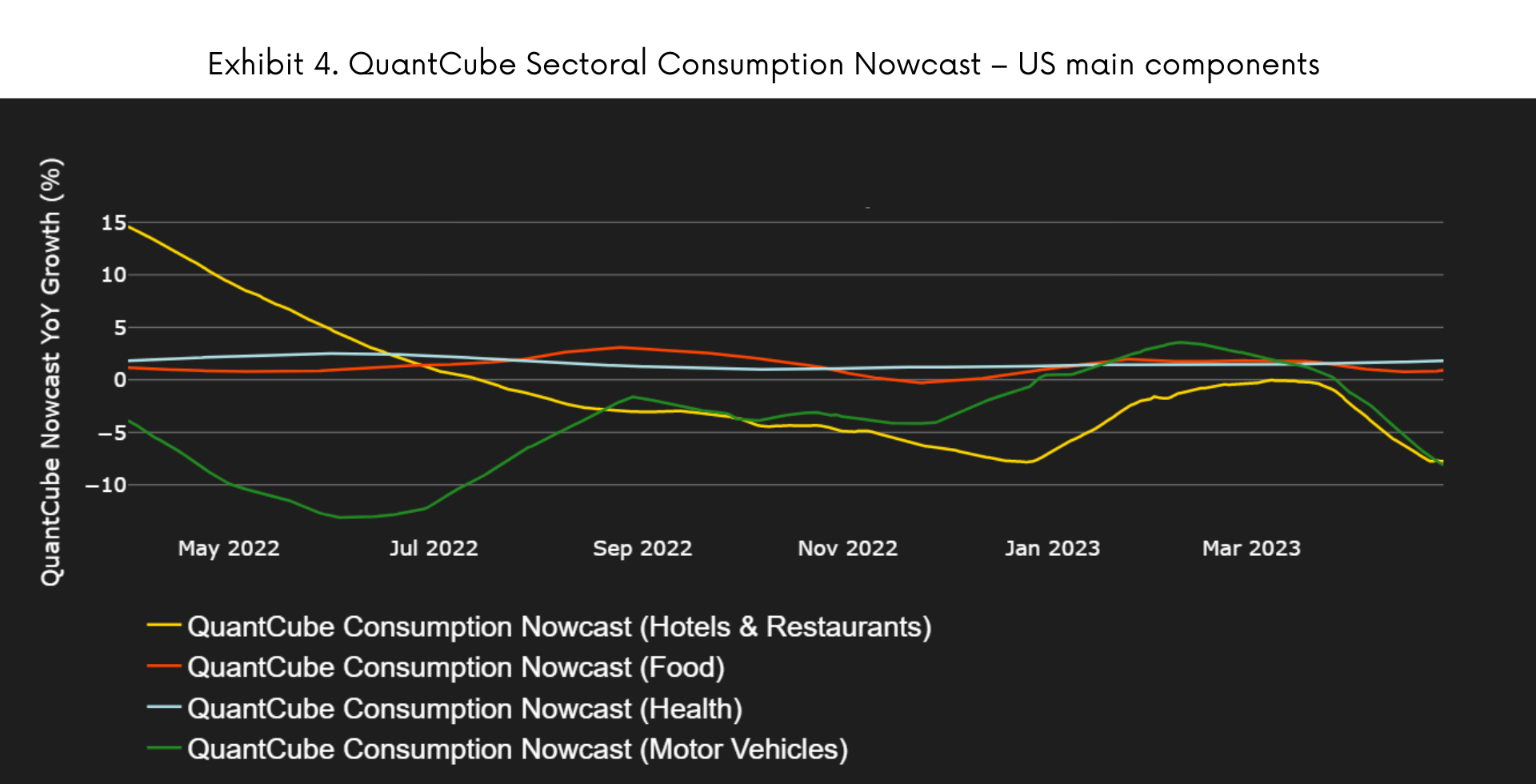

So what is driving this weak consumption trend in the US? In Exhibit 4 we examined how each main component contributed to the overall US consumption trend. Our observation suggests that US consumers started to cut back on non-essential expenditures such as car purchase, restaurant and accommodation services, while the spending for essentials such as food and health have remained stable. In our view, slower spending on non-essentials due to elevated prices, high interest rates and deteriorating credit conditions is evidence that the US economy is losing steam.

Labour market is weakening

Using the QuantCube Job Openings Nowcast, we have examined the current labour market condition for the key sectors in the US economy (Exhibit 5). To provide timely insights, we analyse and aggregate thousands of online job offers on a daily basis and track the evolution of official job openings at country and sectoral levels. At the beginning of the year, the job openings in Consumer Discretionary, Industrials and Financials spiked considerably. However, in the last few weeks the outlook for US labour market seems to have shifted significantly, with all key sectors now recording a downward trend, indicating that a weaker labour market is developing in the US.

Central Banks generally perceive a slowdown in the job market as a necessary step to reduce excess demand in order to get domestic inflation back to more sustainable levels. However, a persistent and long-lasting decline in labour market conditions could also weaken US consumption further and increase recessionary pressures. While a slowdown in the US economy seems inevitable, its timing and depth will probably depend on the evolution of consumption and labour market in the coming months. Our analysis suggests that economic growth and consumption activities in China often led global economic growth in the past. Our real-time indicators should help us to see if China is able to rescue the global growth again.