Navigating the shifting landscape of the global oil market

Commodities Insight

QuantCube’s analysis for global oil market dynamics

The global oil market is undergoing significant shifts as key players like Saudi Arabia and Russia navigate rising domestic demand, geopolitical tensions, and evolving global demand dynamics.

Saudi oil exports drop amid weak global demand and rising domestic consumption

Saudi Arabia, the world’s largest crude oil exporter, has seen overseas shipments drop over the last few months. This decline is driven by intense competition in key markets and a significant rise in domestic demand. Seasonal factors have likely contributed to this downturn, as soaring temperatures increased the need for oil in power generation to keep air conditioners running. Despite a slight uptick in the last few weeks, Saudi exports remain negative on a year-on-year basis.

Russia's oil exports plunge amid OPEC+ compliance and Ukrainian drone attacks

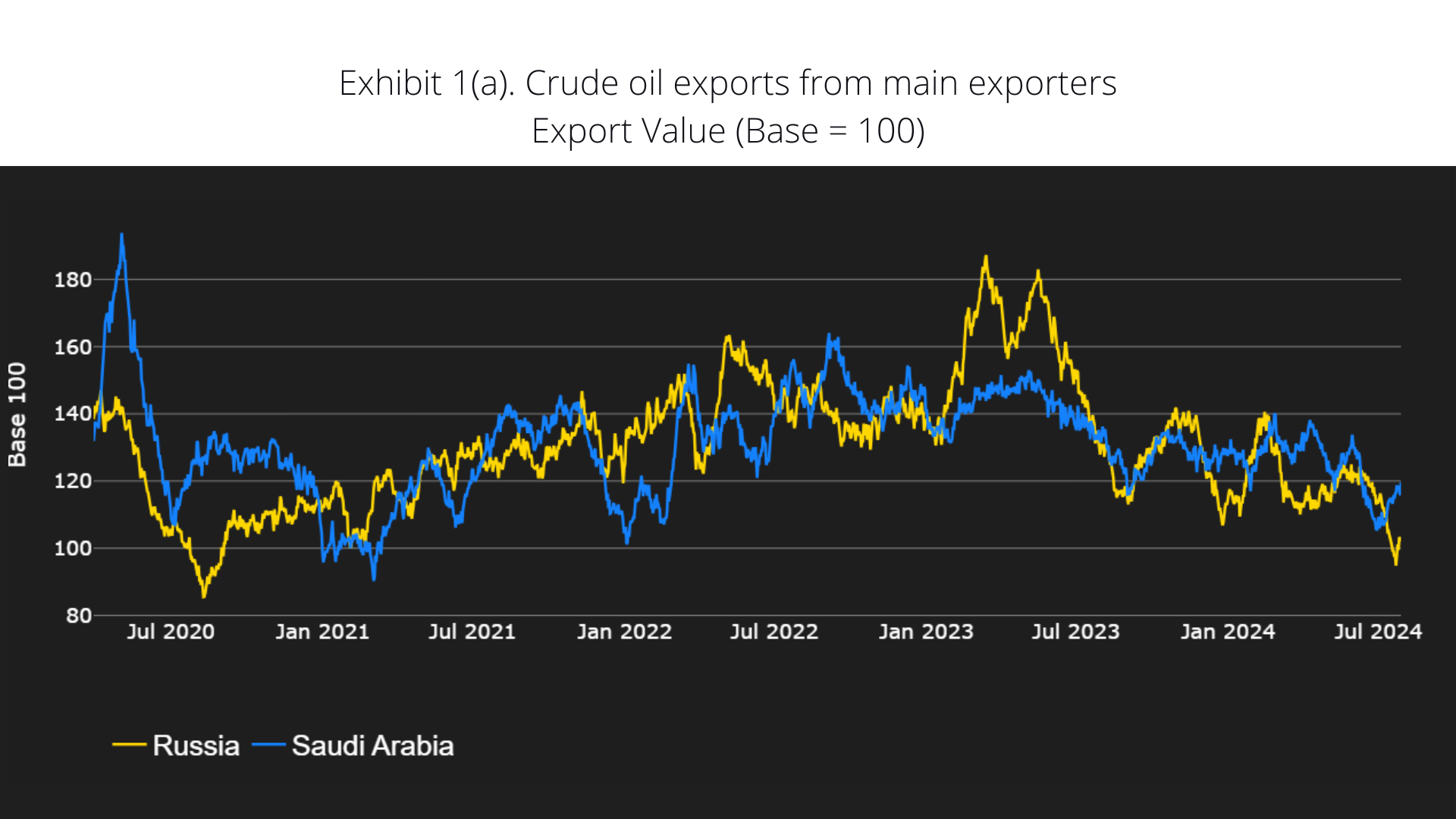

As Exhibit 1 illustrates, Russian oil exports have been dropping since the beginning of 2023, with a 21% decrease compared to a year ago and a continued downward trajectory. This decline is largely due to Russia’s efforts to comply with the production cuts mandated by the OPEC+ oil cartel. To make up for previous overproduction, Russia may further reduce its output in the coming months.

Additionally, the situation has been exacerbated by Ukraine resuming drone attacks on Russian oil refineries in early July. These attacks are likely to disrupt Russia's oil production and export capabilities even further.

US sanctions disrupt Russia-China trade amid heightened restrictions

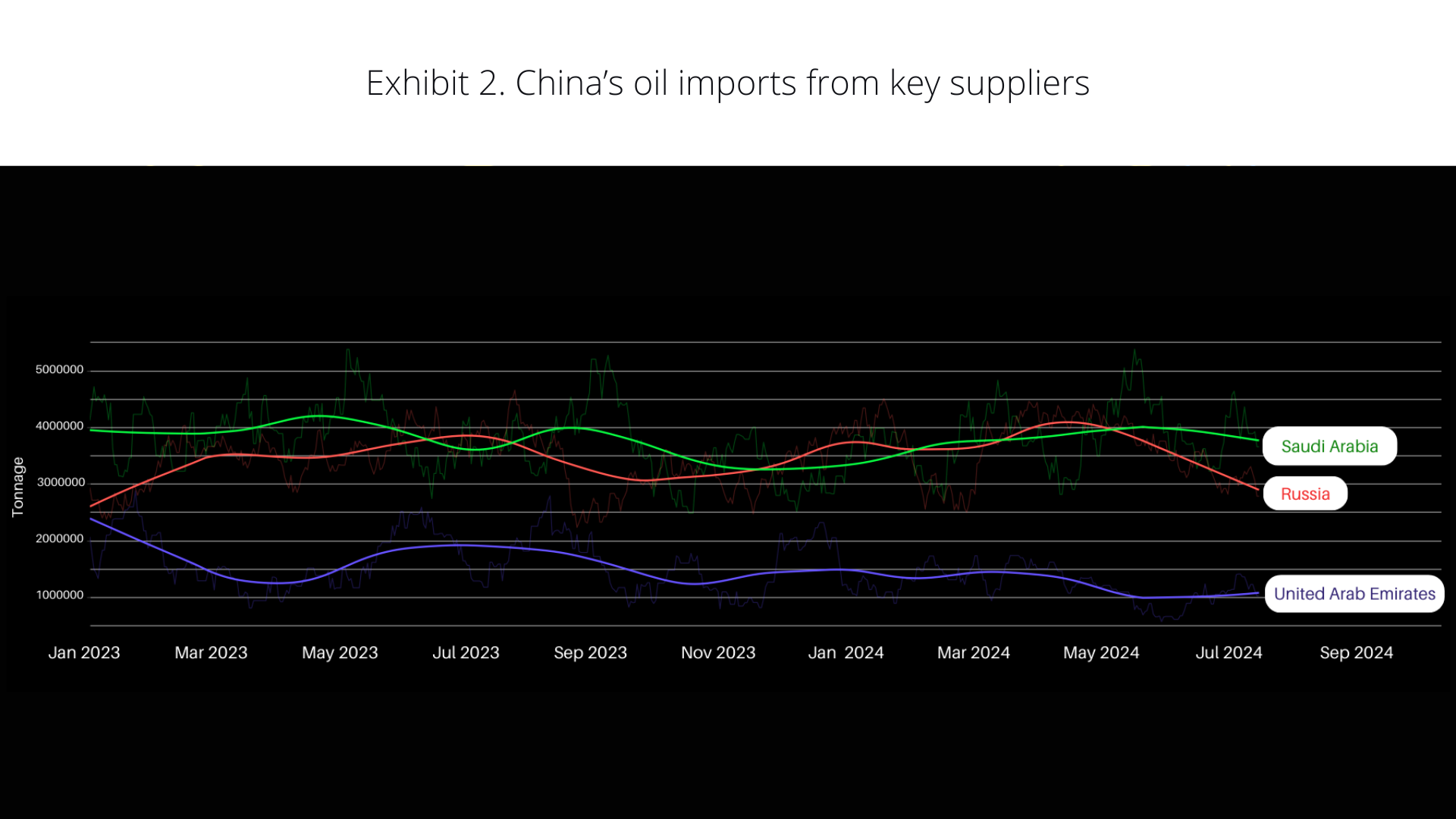

Adding to these challenges, US sanctions have significantly disrupted trade between Russia and China, a crucial wartime partner for Russia. Chinese businesses are increasingly wary of US sanctions, leading to a significant drop in Chinese imports of Russian crude oil, as shown in Exhibit 2. This decline coincides with the expansion of US sanctions in mid-June, which targeted over 300 new entities and individuals involved in supporting Russia's war efforts and circumventing sanctions.

India – Robust industrial activity fuels oil demand in Asia's third-largest economy

India, the world's third-largest oil importer and consumer after the US and China, has seen a significant increase in its crude oil imports.

According to the QuantCube Crude Oil Imports Nowcast for India, the country’s imports have surged recently. On a year-over-year basis, Indian crude oil imports rose by 17% compared to the previous year, and by 24% in the last three months alone (Exhibit 3).

Discounted Russian barrels find eager buyers in India

As illustrated in Exhibit 4, India's recent surge in oil imports has been notably influenced by increased purchases from Russia, resulting in a decreased share of Middle Eastern oil in the country’s crude mix.

Indian refiners have seized the opportunity to capitalize on discounted Russian oil, which became more accessible after European countries reduced their imports following Russia’s invasion of Ukraine in February 2022. Last month, the availability of Russian oil was particularly high, with even deeper discounts offered due to lower demand from China.

Strong industrial activity boosts oil demand in India

India’s increase in oil imports appear to be primarily driven by the country’s rising manufacturing activity, as reflected in our Nowcasting Indicators. As shown in Exhibit 5, the QuantCube Manufacturing Nowcast for India has consistently remained well above the expansion threshold and has been on an upward trajectory in recent months.

Exhibit 6 shows the trend changes over 30 days of the QuantCube Manufacturing Nowcast across key developed and emerging economies. Notably, India stands out as one of the few countries experiencing accelerating manufacturing activity, contributing to global growth alongside emerging economies like Brazil. In contrast, most developed economies and China are facing a slowdown.

Given its robust industrial activity and rising influence in the global market, could India potentially overtake China as the world’s primary growth engine anytime in the near future ?